Nimble Gold Loan Origination System is an Open API-based system with a flexible, multi-tenant architecture that allows faster application processing and disbursal to the customer. It is a modular and scalable system designed to offer comprehensive software solutions that work together seamlessly to provide operational and functional assistance to banks and other financial institutions.

Below listed are certain key attributes of Nimble Gold LOS

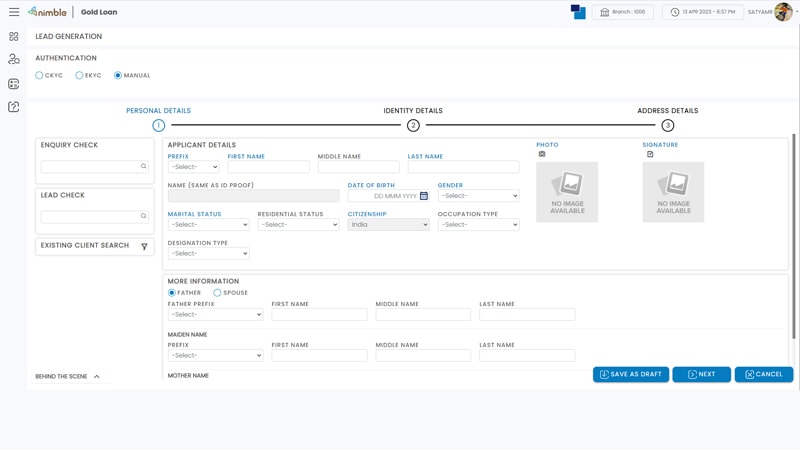

- It offers a light workflow to support the speed and agility required in the gold loan business

- It is built to meet the needs of the tight regulations and risk factors of gold loan

- It can handle a great volume of loans with quicker document processing and faster TAT, which decreases risk, and enhances operational efficiency leading to greater profitability for lending business

key features

- An Open API based system

- NPA Marking

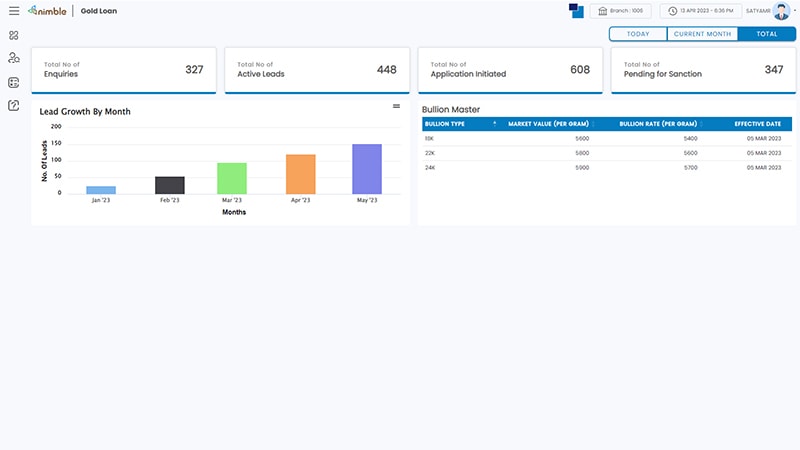

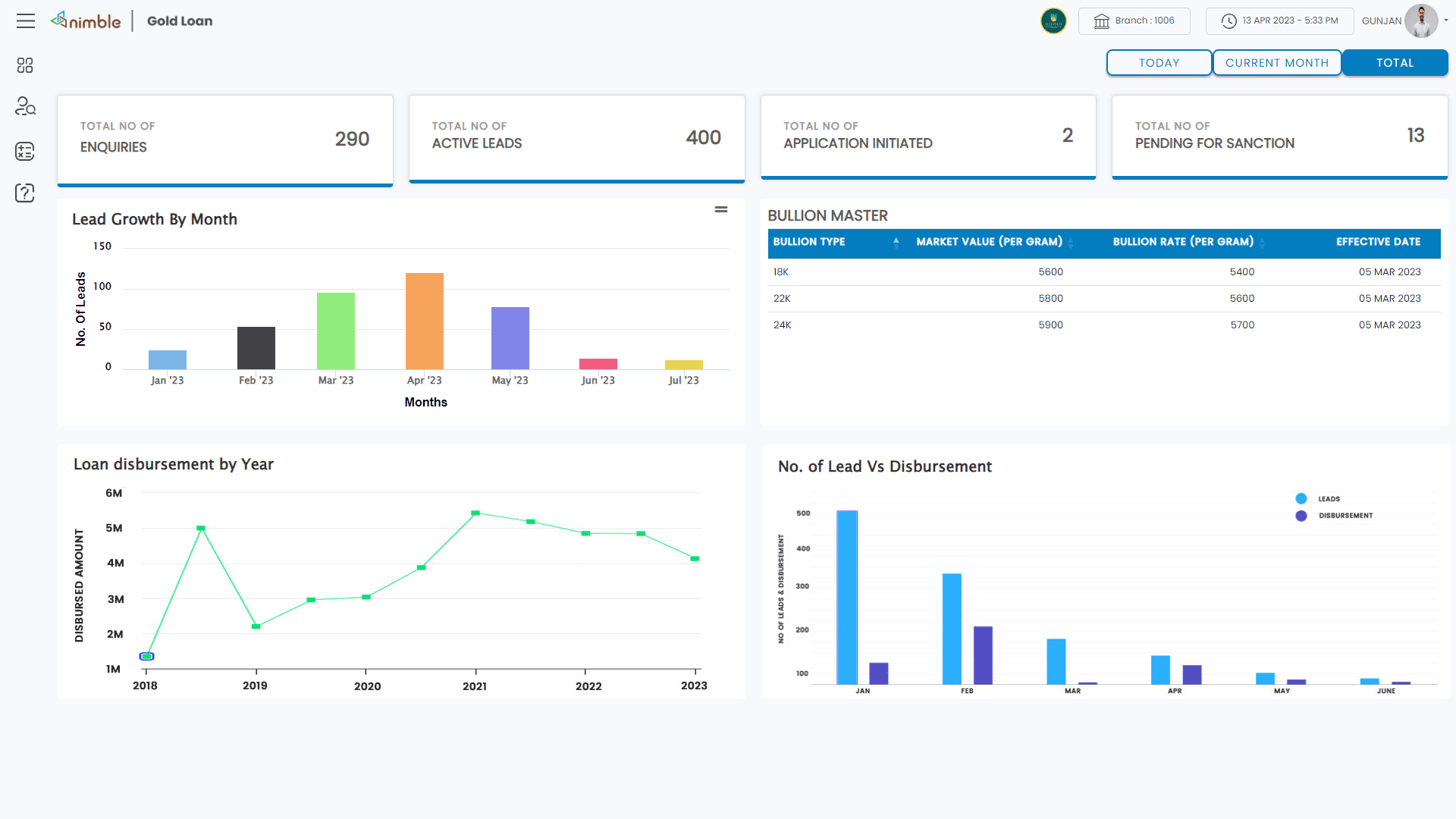

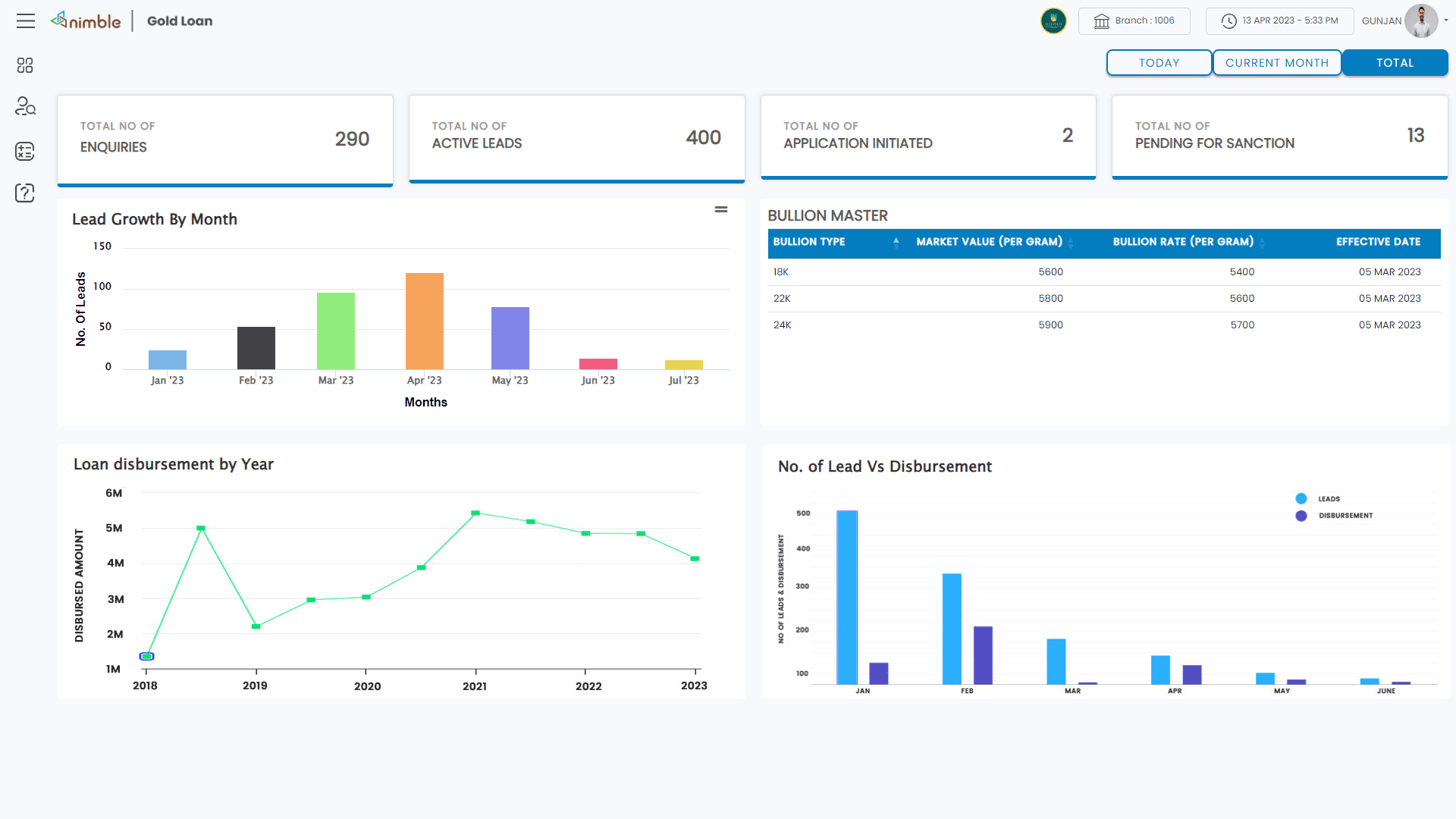

- Bullion Rate with value master

- Collateral Management

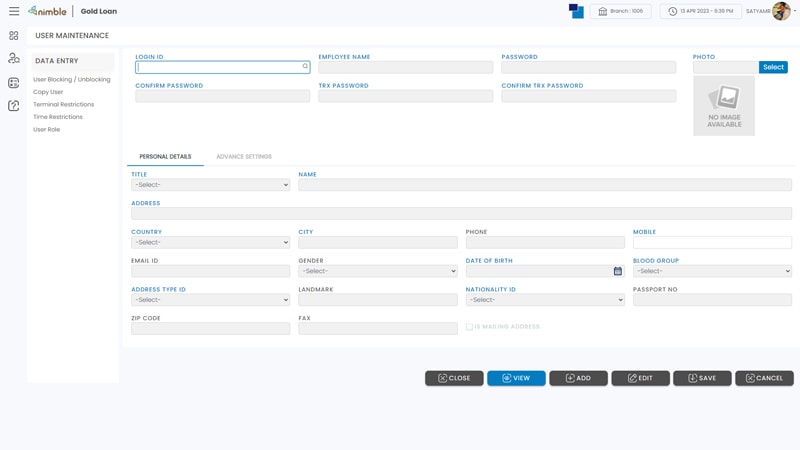

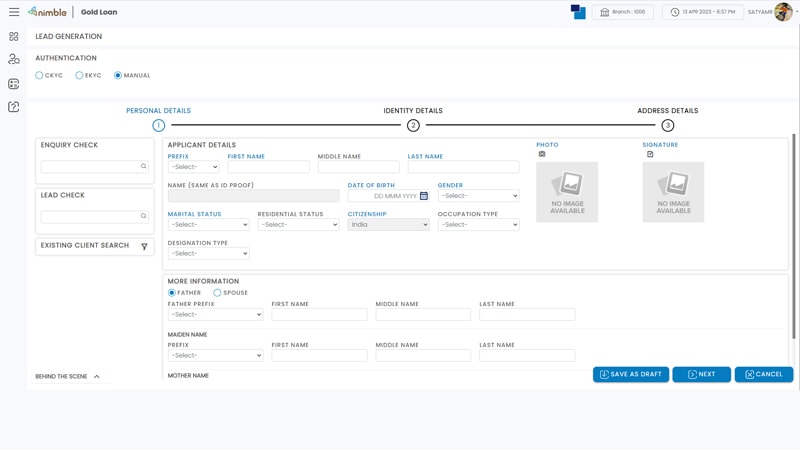

- Client Management

- Pre-closure of loan, Partial & Full Ornaments Release

- Pre-integrated end to end Micro-lending ecosystem

- Built-in compliance to regulatory and statutory requirements

- Parameterized product and process management

- Predictive analytics and dashboarding for all user levels

- Robust financial accounting

- Better adaptability to support customer growth and demography

- Supports both Group and Individual loan management

- Secure credit and risk management

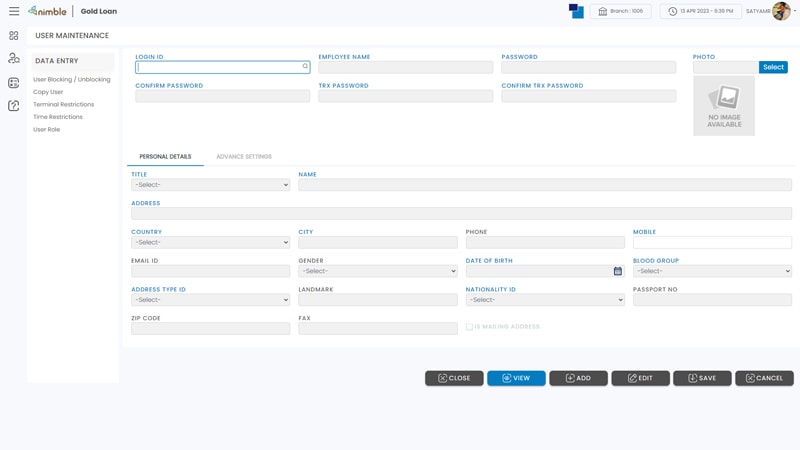

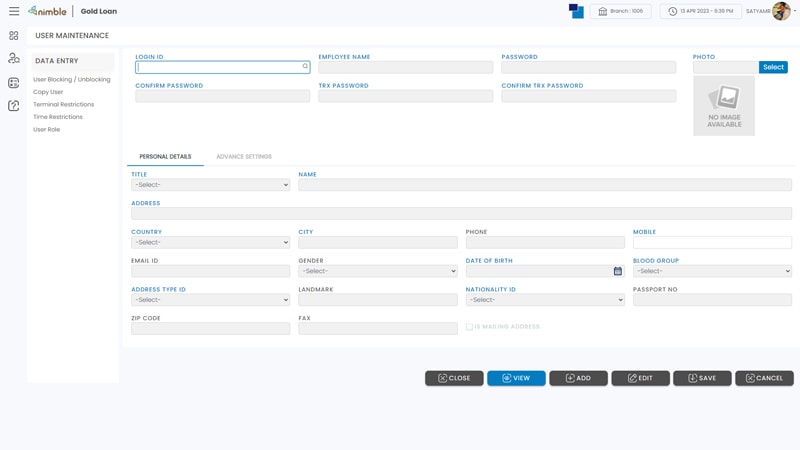

Capable of handling unlimited branches/accounts/customers across a range of modules, from front desk to back office operations.

- Real-time tap on performance & productivity

- Sturdy infrastructure to support unlimited transactions at any given point of time

- High-availability architecture design to mitigate any unforeseen outages

- Integration ready platform to support any 3rd party application

Capable of handling unlimited branches/accounts/customers across a range of modules, from front desk to back office operations.

- Real-time tap on performance & productivity

- Sturdy infrastructure to support unlimited transactions at any given point of time

- High-availability architecture design to mitigate any unforeseen outages

- Integration ready platform to support any 3rd party application

Capable of handling unlimited branches/accounts/customers across a range of modules, from front desk to back office operations.

- Real-time tap on performance & productivity

- Sturdy infrastructure to support unlimited transactions at any given point of time

- High-availability architecture design to mitigate any unforeseen outages

- Integration ready platform to support any 3rd party application

Capable of handling unlimited branches/accounts/customers across a range of modules, from front desk to back office operations.

- Real-time tap on performance & productivity

- Sturdy infrastructure to support unlimited transactions at any given point of time

- High-availability architecture design to mitigate any unforeseen outages

- Integration ready platform to support any 3rd party application

- An Open API based system

- NPA Marking

- Bullion Rate with value master

- Collateral Management

- Client Management

- Pre-closure of loan, Partial & Full Ornaments Release

key benefits

Drive your MFI success story with the right technology

Simple Loan Acquisition Procedures

Reduced TAT in loan disbursal with automated processes and optimized workflow

Modular and scalable system to suit specific Customer requirements

clients

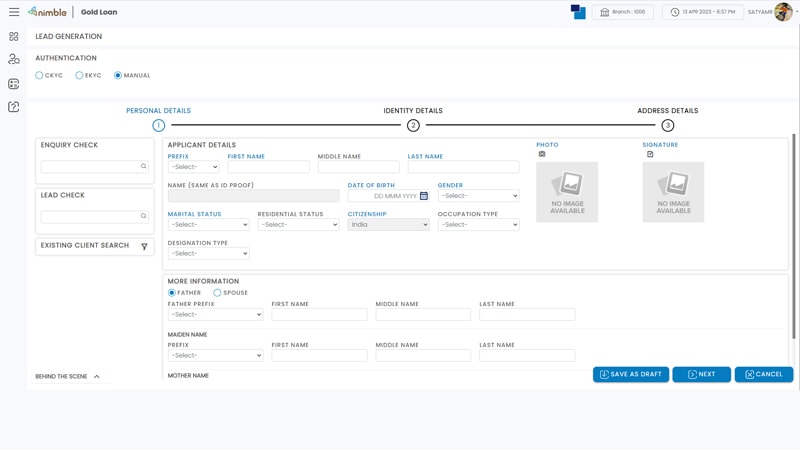

Nimble Gold Loan is a robust and user-friendly software that streamlines the entire gold loan process, from loan origination to repayment and management. Our solution also allows third-party integrations, such as Payment Gateway, ID verification using C-KYC or e-KYC, e-Sign, and bank account verification. From enquiry to validation & sanction, it creates a seamless dynamic workflow.

With its comprehensive features and seamless third-party integrations, Nimble Gold Loan Solution from Craft Silicon ensures a streamlined and efficient gold loan process, enhancing both operational efficiency and customer satisfaction.

clients

Case Study

Craft Silicon joined hands with Ujjivan since its inception & have been their growth partner throughout the journey.

Client Speak

Martin Pampilly

Chief Operating Officer,

Ujjivan Small Finance Bank

clients

Case Study

Craft Silicon joined hands with Ujjivan since its inception & have been their growth partner throughout the journey.